By Rolla Hassan, Ph.D

The semiconductor industry has long been the backbone of modern technology, enabling the myriad electronic devices that have transformed our world. As we venture further into the 21st century, the global semiconductor market is poised for continued growth, driven by a confluence of powerful market forces.

Market Drivers and Demand At the heart of the semiconductor industry’s expansion are several key market drivers. Chief among them is the relentless consumer demand for increasingly sophisticated electronic gadgets – from smartphones and tablets to the burgeoning Internet of Things (IoT). The proliferation of data-hungry applications, artificial intelligence, and cloud computing has also fueled the need for ever-more powerful and efficient semiconductors.

Additionally, the global shift towards renewable energy and electric vehicles has created new avenues of semiconductor demand. Modern wind turbines, solar panels, and electric car powertrains all rely heavily on semiconductor technology.

The vast majority of semiconductor demand is driven by products ultimately purchased by consumers, such as laptops, smartphones, automobiles, and more. Increasingly, consumer demand is driven in emerging markets including those in Asia, Latin America, Eastern Europe, and Africa.

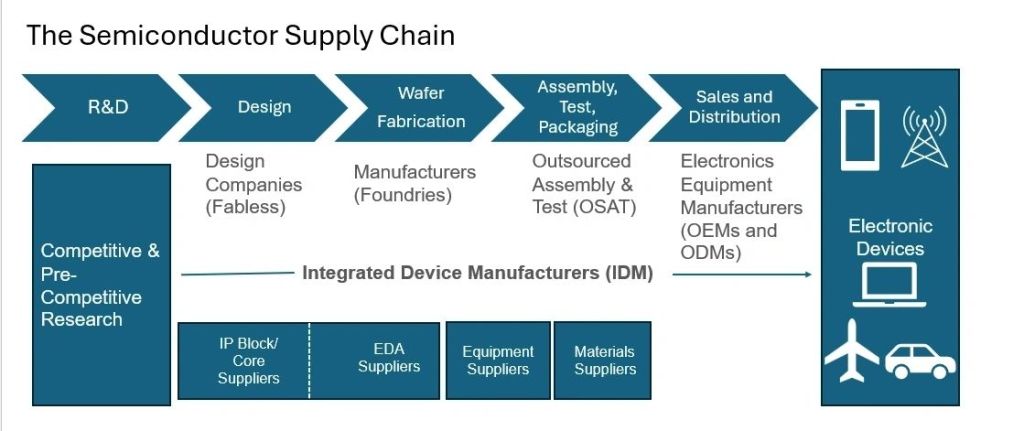

Stages in the semiconductor value chain

A. Semiconductor Categories:

1- Integrated Circuits (ICs):

o Memory

o Logic

o Micro

o Analog

2- Optoelectronics

3- Discrete

4- Sensors

B. Semiconductor Production Process:

- Design

- Fabrication

- Assembly and Testing

Industry Structure, due to increasing complexity and costs in IC production, many companies now specialize in specific steps:

- Fabless Companies:

- Focus solely on chip design

- Examples: Qualcomm (US), Nvidia (US), HiSilicon (China)

- Collaborate with foundries for manufacturing

2. Foundries:

- Manufacture chips in fabrication plants (fabs)

3. Outsourced Semiconductor Assembly and Test (OSAT) Companies:

- Perform final testing, assembly, and packaging

- This step may also be done by the foundries themselves

The semiconductor value chain, comprising a diverse array of global chip players, serves as the backbone of the modern economy. These companies work in concert to facilitate the design, production, and distribution of semiconductors, which are essential for countless applications across various industries. The collective strength and collaboration among these stakeholders ensure a steady supply of advanced technologies that drive innovation and efficiency. This interconnected network not only supports existing tech infrastructure but also fosters the development of new solutions, highlighting the critical role of semiconductors in shaping the future of global commerce and technology. The figure below illustrates a simplified flow of this value chain, offering insight into the intricate processes involved.

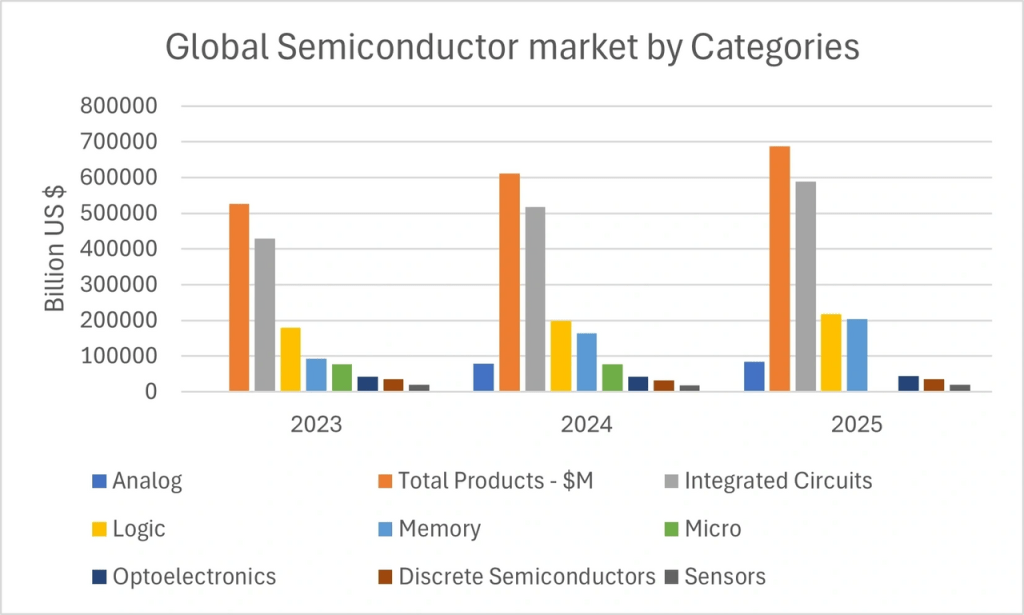

This graph shows the global market revenue for semiconductors from 1987 to 2025, with projections for future years. Overall growth trend, the semiconductor market has shown consistent growth over the nearly 40-year period, with revenue increasing from near zero in 1987 to projected values of around 700 billion dollars by 2025.

The market shows consistent growth across all regions. Asia Pacific dominates, followed by the Americas, Europe, and Japan. Total world market is projected to reach nearly 700 billion USD by 2025.

The market is divided into several categories, with Total Products, Integrated Circuits, and Logic being the largest segments. Memory and Micro components also represent significant portions. All categories show growth over the three years.

Key Factors Enabling Semiconductor Investment

These factors highlight the complex decision-making process for semiconductor companies when choosing locations for investment and operations. The industry requires a combination of financial, human, and infrastructural resources, along with a supportive regulatory environment and ecosystem to thrive.

References

SIA 2024 factbook

Attracting chips investment: industry recommendations for policymakers

https://www.semiconductors.org/attracting-chips-investment/

The global semiconductor value chain A technology primer for policy makers

Harnessing the power of the semiconductor value chain

https://www.accenture.com/us-en/insights/high-tech/semi-value-chain

World Semiconductor Trade Statistics (WSTS)

Leave a comment